Top 30 Forex Brokers Things To Know Before You Get This

Top 30 Forex Brokers Things To Know Before You Get This

Blog Article

The Greatest Guide To Top 30 Forex Brokers

Table of ContentsFascination About Top 30 Forex BrokersFascination About Top 30 Forex BrokersThe Facts About Top 30 Forex Brokers RevealedTop 30 Forex Brokers Fundamentals ExplainedWhat Does Top 30 Forex Brokers Do?All About Top 30 Forex BrokersFascination About Top 30 Forex BrokersThe Definitive Guide to Top 30 Forex Brokers

Each bar chart stands for one day of trading and has the opening price, highest possible price, least expensive cost, and shutting rate (OHLC) for a trade. A dashboard on the left represents the day's opening price, and a comparable one on the right stands for the closing price.Bar graphes for currency trading help investors identify whether it is a purchaser's or vendor's market. The top section of a candle is used for the opening rate and highest possible price factor of a money, while the lower portion shows the closing cost and least expensive price point.

Things about Top 30 Forex Brokers

The formations and shapes in candle holder charts are utilized to identify market direction and movement.

Financial institutions, brokers, and dealerships in the forex markets permit a high quantity of utilize, indicating traders can regulate large positions with reasonably little cash. Leverage in the series of 50:1 prevails in forex, though even better amounts of utilize are available from particular brokers. Nevertheless, leverage should be made use of meticulously due to the fact that lots of unskilled traders have actually endured significant losses utilizing more utilize than was needed or sensible.

Fascination About Top 30 Forex Brokers

A money trader needs to have a big-picture understanding of the economic climates of the numerous nations and their interconnectedness to realize the principles that drive currency worths. The decentralized nature of foreign exchange markets indicates it is less controlled than other economic markets. The degree and nature of regulation in foreign exchange markets rely on the trading jurisdiction.

Foreign exchange markets are amongst the most liquid markets worldwide. They can be less unstable than other markets, such as real estate. The volatility of a certain money is a feature of several variables, such as the politics and economics of its nation. Occasions like financial instability in the form of a settlement default or imbalance in trading relationships with another money can result in considerable volatility.

Unknown Facts About Top 30 Forex Brokers

The Financial Conduct Authority (https://pxhere.com/en/photographer-me/4163890) (FCA) monitors and controls forex sell the United Kingdom. Currencies with high liquidity have an all set market and display smooth and foreseeable rate action in response to exterior occasions. The united state buck is the most traded money worldwide. It is paired in six of the market's seven most liquid currency sets.

The smart Trick of Top 30 Forex Brokers That Nobody is Talking About

In today's details superhighway the why not check here Foreign exchange market is no more entirely for the institutional financier. The last ten years have actually seen a rise in non-institutional investors accessing the Foreign exchange market and the benefits it offers. Trading platforms such as Meta, Quotes Meta, Investor have actually been developed particularly for the private capitalist and academic product has actually come to be more readily available.

The 6-Second Trick For Top 30 Forex Brokers

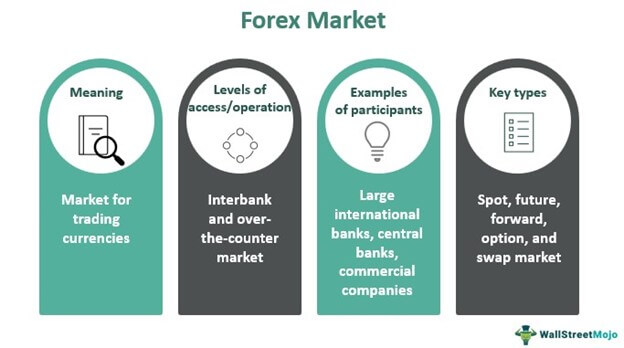

Fx trading (foreign exchange trading) is a global market for dealing money. At $6. 6 trillion, it is 25 times bigger than all the world's supply markets. Forex trading determines the exchange rates for all flexible-rate currencies. Consequently, prices transform frequently for the money that Americans are probably to use.

When you offer your currency, you obtain the settlement in a different currency. Every tourist that has actually gotten foreign money has done foreign exchange trading. The trader buys a certain money at the buy price from the market manufacturer and sells a different currency at the marketing price.

This is the purchase expense to the trader, which consequently is the revenue gained by the market manufacturer. You paid this spread without recognizing it when you traded your dollars for international currency. You would see it if you made the deal, canceled your trip, and afterwards attempted to exchange the currency back to bucks immediately.

The 8-Minute Rule for Top 30 Forex Brokers

You do this when you think the currency's worth will certainly fall in the future. If the currency rises in worth, you have to buy it from the dealer at that cost.

Report this page